Attention Substack users! ETO blog posts are also available on Substack.

Today, the Emerging Technology Observatory is launching a major update to our Semiconductor Supply Chain Explorer. This tool offers policymakers and researchers an open, interactive way to understand the essential inputs, countries, and companies involved in producing advanced chips.

Tool Updates

The new version of the tool features two major updates, which enhance the detail and timeliness of the tool:

- Company-level market shares: the tool now displays company-level market shares, when available, alongside previously-available country-level shares.

- Updated with 2024 data: the tool now displays 2024 market sizes and shares, when available (updated from 2019 data).

Shifting Trends

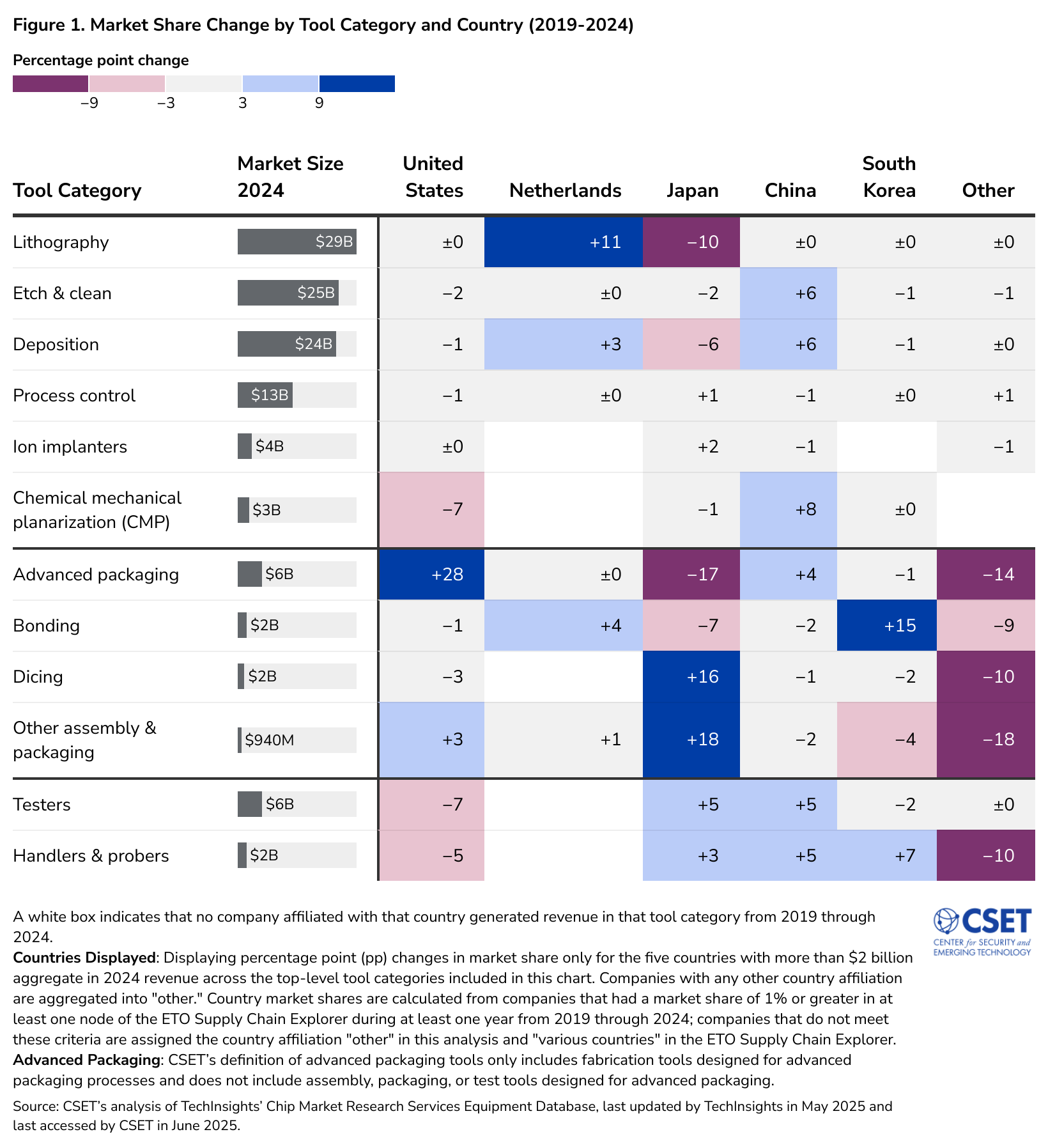

Accompanying this update, CSET published a blog post assessing China’s growing market share in chipmaking tools. Analyzing the updated data, we find that Chinese semiconductor manufacturing equipment (SME) companies are gaining market share in several notable technologies, consequently eroding foreign incumbents’ market shares.

From 2019 to 2024, Chinese SME firms have made notable gains in equipment used in fabrication—the first stage of chip manufacturing, particularly in chemical mechanical planarization (CMP) tools, dry etch and clean tools, and deposition tools; however, lithography, the most complex tool category, remains a critical constraint for China.

To read more of our analysis of the updated data, read our blog post. For more insight into the current state of the advanced chips supply chain, dive into the updated Explorer. As always, we're glad to help - visit our support hub to contact us, book live support with an ETO staff member or access the latest documentation for our tools and data. 🤖